Research shows director networking has impact on company success

On corporate boards, who the directors know and the networks they belong to can make a difference in the success of the company in securing excellent credit ratings crucial to its success.

University of New Mexico Professor Subramanian Iyer recently published a paper called Director Networks and Credit Ratings in The Financial Review that explores the link among company board members, their professional connections, and company credit ratings. He used software deployed on systems at the UNM Center for Advanced Research Computing in his research that explores the basic question whether better connected board members help companies secure a better credit rating.

University of New Mexico Professor Subramanian Iyer recently published a paper called Director Networks and Credit Ratings in The Financial Review that explores the link among company board members, their professional connections, and company credit ratings. He used software deployed on systems at the UNM Center for Advanced Research Computing in his research that explores the basic question whether better connected board members help companies secure a better credit rating.

Credit rating agencies (CRAs) such as Standard & Poor’s and Moody’s attempt to correctly assign accurate ratings to companies using financial information. They also use qualitative information such as quality and qualifications of management and board members. His research shows that companies with highly connected board members enjoy superior credit ratings

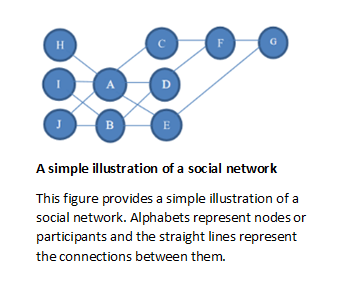

Each board member brings to their position their own contacts and connections. Connections are developed through commonalities such as geographical location, industries, education, and other professional bonds, Iyer explained. The board member becomes the bridge between the network and the other board members’ connections and vice versa, expanding the network. Board members may shift companies, taking those connections with them and expanding the network.

As an example, Iyer pointed to the board of directors of Apple, Inc., world famous maker of the iPhone, iPad, MacBook, and other popular devices. Board members and their connections include:

- Andrea Jung – former CEO of Avon, who is also a member of the board of directors of General Electric.

- Al Gore Jr. – former vice president of the United States and Nobel Peace Prize winner, who is also a senior advisor to Google.

- James Bell – former CFO, CEO, and president of Boeing.

- Timothy Cook – CEO of Apple Inc. who is also a member of the board of directors of Nike.

- Bob Iger – chairman and CEO of the Walt Disney Company.

- Arthur Levinson – chairman of Apple Inc. and CEO of Calico, a company created by Google.

- Ronald Sugar – chairman and CEO of Northrop Grumman and director of Chevron Corporation.

- Susan Lynne Wagner – co-founder, COO, and vice chairman of BlackRock, the world's largest asset manager.

Using the Apple corporation example, Iyer observed, the members are highly influential and bring a lot of powerful connections to the company, which then become connections and part of the network of the other members.

“The general expectation is that the board members will continue to do the right thing, make the right decisions for the company,” Iyer explained. The CRAs see the board members’ reputation as a sign of trust.

“Apple has an AA+ credit rating from S&P, which is excellent and that means Apple can borrow at lower interest rates compared to other companies that do not have AA+,” Iyer said. Good credit ratings means better interest rates on money borrowed, which companies can use for a number of purposes such as improving and growing the company, research and development, more facilities, and expansion to new locations, he explained. For a large company like Apple, this rating has huge financial benefits.

The benefits of successful networking cannot be emphasized enough, Iyer said. The network statistics such as number of connections, betweenness, closeness, and eigen vector centrality measures (connections to a highly connected person and benefiting as a result of those connections) shed light on the importance of influential directors and can potentially answer many novel questions regarding corporate actions and shareholder welfare.

Because the number of connections and networks grow exponentially, rather than linearly, and change from year to year, Iyer needs computer power, storage, and memory to deploy the software that measures and maps the vast number of connections as they change and expand.

“This is why we use CARC. Normal computers cannot do this,” Iyer said.

See the complete paper here.